🥥 From Coconut Cocktails to Capitalism Collapse (and Why Mindset Matters)

From coconuts in Sri Lanka to financial uncertainty and the climate crisis, this article explores how to stay grounded, rethink your wealth, and take meaningful action in a world facing deep change. A practical, personal guide to living with purpose in uncertain times.

Consistency is proving to be like a coconut — a hard nut to crack! I've been a bit overwhelmed recently, hence the brief hiatus from writing. A manic period of stuff to sort out, before heading off on my travels. I'm writing to you from a sweltering but stunning Sri Lanka, where there are coconuts a plenty! 😎

If you ever find yourself in this part of the world, I can wholeheartedly recommend coconut arrack (Sri Lanka’s own whiskey), as well as fiery coconut sambal and egg hoppers for breakfast. Some of the many sensory and culinary delights — and also a reminder that slowing down can sometimes be the best way to reset.

In that spirit, I plan to experiment with shorter pieces and varied formats as I get back into the groove. The goal remains: meaningful content that helps navigate financial life in a changing world.

Reflections from Ruins

The photo above is from the ancient city of Polonnaruwa — a once great capital of Sri Lanka, and now an evocative set of ruins. Inspiring to think this could be a place where my ancestors lived. But also a place where you can't help but be reminded that even the greatest civilisations can crumble. It is rare to find true permanence in this world. A reminder to build wisely, plan intentionally and prepare to expect change.

Markets, Mayhems and Misconceptions

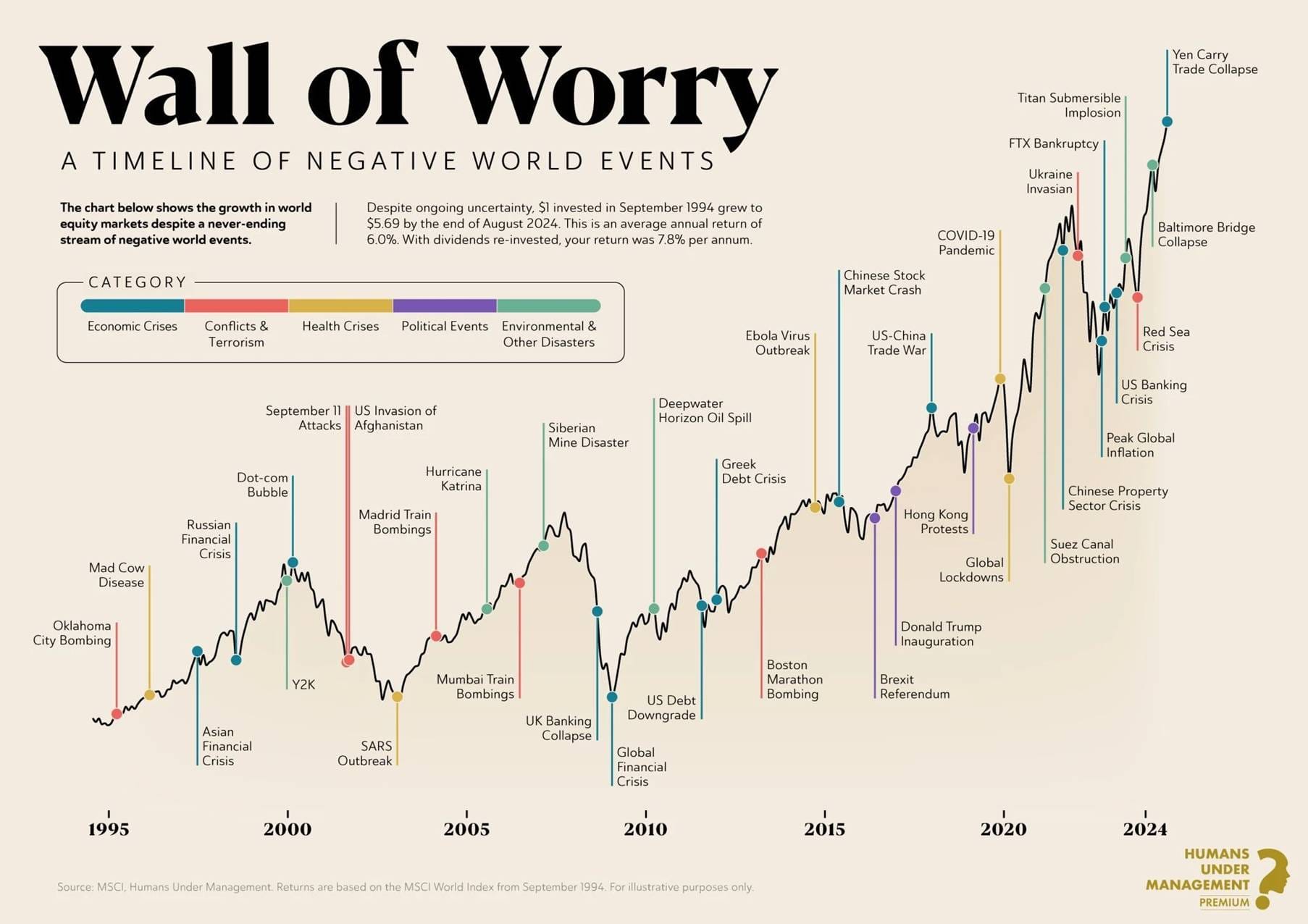

In the month since my last article, a lot has happened, particularly in the markets. The big headline-grabber: Donald Trump's liberation day that sets free a global trade war. While his recent actions may seem somewhat out of the ordinary, an important reminder:

Market volatility is not new. It’s part of the investing journey.

Take a look at long-term global equity returns in the chart below. Despite multiple crises over the past 30 years — dot-com crash, financial crisis, COVID, and now geopolitical uncertainty — the MSCI World Index still grew by 7.8% per year (from Sep 1994 to Aug 2024, with dividends reinvested). The chart tells a clear story: growth is possible, despite the stream of negative events, and many ups and downs along the way.

This underlines the importance of staying invested. Panic selling during a market downturn can be highly damaging over the longer term, as you miss out on market recoveries. Using emotions to drive financial decision-making is seldom a good idea.

Nonetheless there is also some important counter balancing to this message.

1. The Retirement Tightrope

Market volatility is particularly unhelpful for retirees who need to draw an income from their investments. They face a tricky balance:

- Longevity means your money needs to last longer than previous generations.

- Inflation erodes value, so staying invested is critical.

- But withdrawing during downturns means potentially selling at a loss — which compounds the problem.

Solving this conundrum is a major focus of my actuarial work at Milliman. We’re exploring new strategies and products to help retirees navigate this complexity. If you’re curious, check out our latest thinking on our LinkedIn page.

2. Questioning the S&P 500 Love Affair

It’s common to hear many investors, and even some financial planners, say they’re "100% in the S&P 500." After all, U.S. equities have outperformed for years. But there there are the all important caveats to remember:

Past performance is not a guarantee of future returns.

It is advisable not to put all your eggs in one basket.

To provide perspective, equity returns can be poor for extended periods of time. Remember that Japan’s stock market peaked in the late 1980s — and took 34 years to recover. That without dividends reinvested. But even with dividends it still took around 30 years. Could something similar happen to the US?

With the U.S. leaning into protectionism, political polarisation, and corporate concentration, many are questioning whether the “American exceptionalism” is now coming to an end? It'd be wise to question whether the S&P 500’s stellar run of outperformance will continue forever. It’s something difficult to predict, which is exactly why diversifying across different markets and indices is so important.

3. Global Growth: No Longer a Given

Trump's tariff policy has brought an abrupt end to the era of globalisation. Planetary limits are now in breach. The world is simply over-consuming its natural resources. We may be entering a future where growth itself is constrained.

As the current capitalist systems is starting to show signs of crumbling, the idea of a policy of degrowth is actively being considered. "Degrowth" maybe something that is actively pursued by design, as we realise that all other policy avenues lead to a dead-end, or by disaster as the institutions and leaders that are meant to be acting in society's best interest, instead act for a privileged few.. and push the rest of us off a cliff (for more of an in-depth discussion check out Hans Stegeman's essay on this).

It clearly has huge implications for investing, pensions, and financial planning. If growth stalls, where do investment returns come from?

Which brings us on to a bigger question, and the original scheduled topic for this article…

Midway Through the “Decade of Action” — How Are We Doing?

Year 2025. We're now five years into, and halfway through, what was once called the "decade of action". Midway points act both as a milestone and a mirror — a chance to reflect back on what progress has been made, but also a countdown now to looming deadline that is a critical juncture on the way to Net Zero.

2030 was also the target deadline for the UN Sustainable Development Goals (SDGs). 17 highly ambitious goals adopted by all UN member states back in 2015, which if we achieve would be transformational for human society.

So how far off are we?

The "school report card" could be described as "mixed" at best.

UN SDGs – School Report Card (2025)

Overall Grade: C- (Showing Potential, But Falling Short)

The world is struggling to pass its SDG exams! While there’s real progress in some areas (like clean energy and health), too many goals are failing or barely scraping by. Poverty, climate change, and inequality remain big red flags, and without urgent action, we won’t meet the 2030 deadline.

🎓 Subject-by-Subject Grades: SDG Progress Report

| Grade & SDG | Summary |

|---|---|

| 🟡 B+ – SDG 3: Good Health & Well-being | Vaccines & lower child mortality improving, but mental health still lags. |

| 🟡 B – SDG 7: Affordable & Clean Energy | Solar and wind are booming, yet fossil fuels still dominate. |

| 🟠 C+ – SDG 4: Quality Education | School enrolment is rising, but a global learning crisis persists. |

| 🟠 C – SDG 5: Gender Equality | More women leaders, but violence and pay gaps remain widespread. |

| 🟠 C− – SDG 6: Clean Water & Sanitation | Progress made, but 2 billion people still lack access to safe water. |

| 🔴 D – SDG 1: No Poverty | COVID-19 and wars have pushed millions back into poverty. |

| 🔴 F – SDG 2: Zero Hunger | Hunger is rising, driven by climate impacts and ongoing conflict. |

| 🔴 D – SDG 13: Climate Action | Record-breaking heat, slow progress on cutting emissions. |

| 🔴 F – SDG 10: Reduced Inequalities | The richest 1% are capturing most of the world’s new wealth. |

Teacher’s Comments:

"The world has the tools (tech, money, ideas) to ace these goals — but effort is uneven. Renewable energy (A) proves success is possible, while hunger (F) shows deadly neglect. Time to study harder: tax the rich, fund green projects, and leave no one behind!"

Final Verdict: Could do better — must try harder before 2030! 🌍📢

(Key data sources for this assessment are provided in a footnote at the end.)

Time is clearly ticking, and the recent cuts to global aid budgets only heighten the challenge. But as an encouraging parent trying to focus on the positives, it's all about the potential! The world has the solutions to address all these goals. We need to limit distraction and focus on application.

If only it were so simple! That is one of the key themes about my latest fascinating read. A collaborative effort from a group of authors from various backgrounds (their website), exploring why we’re struggling to solve these global crises. One reason? Wicked problems.

Wicked Problems

A wicked problem isn’t evil — it’s complex, interconnected, and resistant to easy solutions. Think climate change, inequality, and corruption. These problems feed into each other, often caused or sustained by entrenched systems of power.

"Every wicked problem is a symptom of another problem."

I'm only midway through this book at the moment. But the biggest takeaway message from the book so far? Power and Corruption is at the root of all the other problems.

A learning point for me has been, when thinking about the most pressing problem of the "Death of Nature" — particularly through climate change — it is easy to get drawn into a myopic focus, or "carbon tunnel vision", of doubling down on our Net Zero pathway as the all-encompassing solution. But ultimately this problem is a symptom itself, of a wider societal malaise, driven by our "individualistic mindset" and an economy built upon self-interest instead of common-interest. We cannot forget our own interdependence and the interconnectedness of everything.

The authors' belief is that the twin crises of climate and inequality are interlaced, fused together and driving one another. Our exploitative capitalist system is leading to concentrations of wealth that are at a scale and proportion that is hard for us to even comprehend.

A few interesting perspectives to understand the wealth of a billionaire:

- If you earn £10,000 a week — a pretty decent sum — you would have to work every week from the year of Jesus's birth until this year, to earn over a billion.

- To earn as much as Elon Musk's net worth at the time of writing — quoted as $180 billion (although rapidly depleting given Tesla's recent fortunes) — you'd need to be earning $10,000 a week for a third of a million of years, which is before Homo Sapiens first emerged in Africa.

- If any of the richest 10 billionaires lost 99% of their wealth, they'd still be a billionaire.

- The wealth of each of the richest 10 men has grown by almost US$100 million a day in 2024 on average.

- There are 902 billionaires in the US alone that own an astonishing $16.1 trillion in wealth, and yet many pay an effective tax rate of less than 1%. The top 1% of earners in the US pay an average tax rate of 23.1%. If billionaires in the US paid the same effective tax rate, they would pay for over double the current US deficit. There would then be no need for DOGE! (see analysis from Will Lockett).

The super-rich are ultimately key for the climate story for three reasons:

- Through their immense carbon footprint (the top billionaires have the annual carbon footprint of 2 million average homes);

- Through their investments and shareholdings, and vested financial interest in the economic status quo;

- Their undue influence that they have over media, economics, politics and policy-making

We’re living through an era of wealth supremacy — and right before our eyes, it’s clear that the ultra-wealthy are doing little to solve our wicked problems, but choosing instead to preserve the status quo.

Why does this matter so urgently?

Crazy Wicked Problems — the Ones That Could Kill Us

Some wicked problems are so urgent, so far-reaching, that if left unsolved, they may not only just disrupt — they may destroy us. These are what the authors call crazy wicked problems. They are the ones that, quite literally, threaten our continued existence.

The book doesn’t shy away from the “E-word”: Extinction.

We are already living through what scientists describe as the Sixth Mass Extinction. According to Living Planet Report 2022, global wildlife populations have declined by an estimated 69% in just 50 years (those that are monitored) — the WWF concludes this is largely due to human activity too.

The billion-dollar question is: Will this extinction event include us too?

We are simultaneously the first generation to have the power to be able to destroy ourselves — but also the first with the power, tools, knowledge and opportunity to live truly sustainably for the benefit of many generations to come. That is an incredible amount of responsibility on our shoulders.

Existential risk is heavy, to say the least — but like any difficult emotion, it’s best confronted head-on.

We all know the best way to deal with fear is to confront it (in albeit small doses). From a personal perspective, bereavement was something that I had to contend with at an early age. It was a difficult journey of acceptance, but one of the positive things that I took away from dealing with it, is the drive to make the most of life ever since. Also probably a reason why I've ended up becoming a life & financial planner, to help others in achieving the most from their lives too. The Stoics called this Memento Mori — the remembrance of death as a motivator to live fully.

A similar reaction is what we need on a global scale in response to extinction risk. A "Collective Memento Mori", appreciating the fragility of our collective existence, as a motivator for change.

What if our awareness of extinction became a catalyst for urgent, meaningful action?

Leverage Points: How Small Shifts Can Move the World

So how do we act?

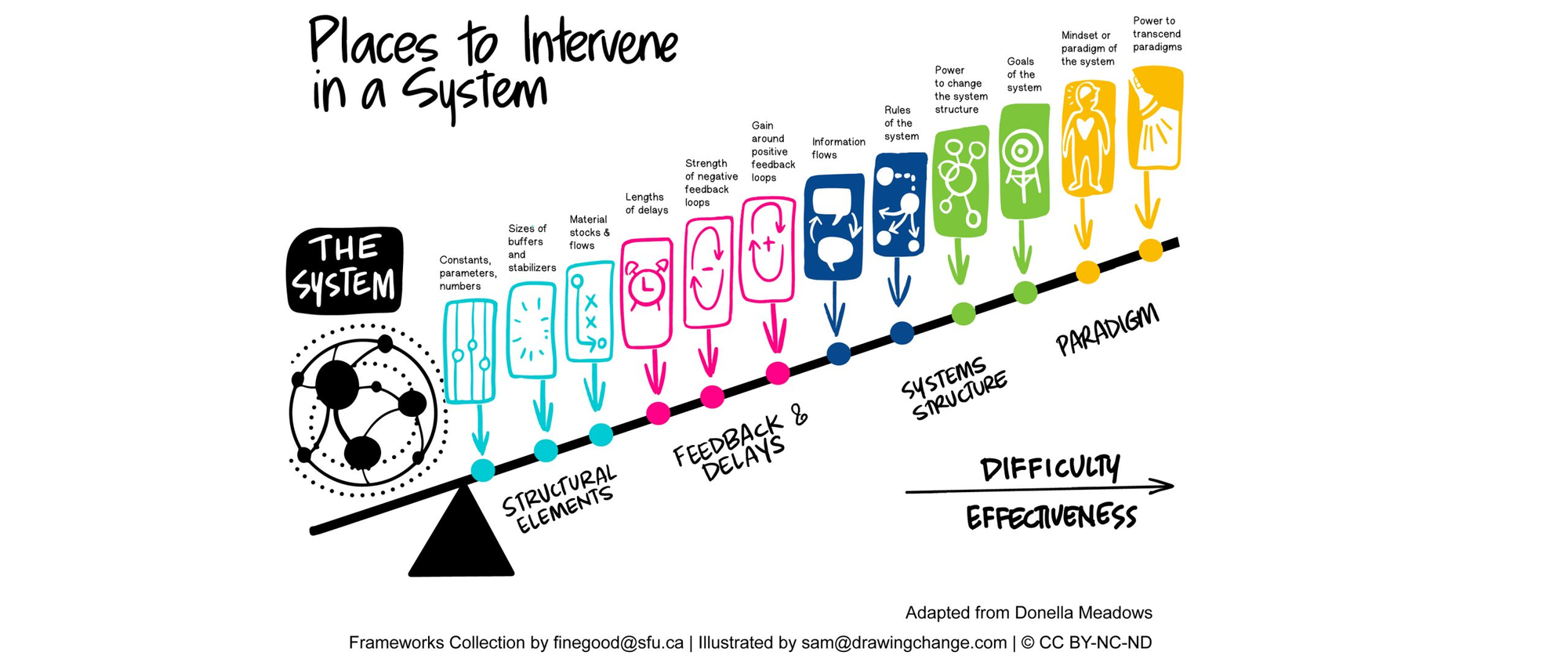

The authors highlight a powerful concept from systems thinker Donella Meadows: leverage points — places within a complex system where a small shift in one thing, can produce big changes in everything. She categorises them in order of effectiveness as follows.

And what are considered the most effective leverage points of all? They are classified as "Paradigm" — a set of assumptions, values, and practices that shape how we perceive reality and make decisions. Perhaps an easier term to describe this is:

Mindset.

If we change how we see the world, we change how we act in it.

You could argue that the collapse of our current system is inevitable. If you believe the fact that we require 1.7 planets to support the current rate of global consumption (see Earth overshoot day analysis), then we cannot defy gravity forever. At the current pace of global change, all of this could very well unfold before you even reach retirement.

Allianz, one of Germany’s largest insurers, has just recently warned that climate change could bring down capitalism — starting with a crisis in insurability that snowballs into a global credit crunch on a colossal scale.

From collapse we have two possible futures — extinction or regeneration. The probability of each is very difficult to predict, and in some ways irrelevant. Uncertainty cuts both ways though. Uncertainty ultimately gives us hope. The possibility that we can find a new path is still real. This becomes more believable if we adopt that future now.

We can’t control the whole system — but we can control our own thoughts, intentions, voice and actions. Applying leverage at the level of mindset means asking:

"What kind of Anthropocene do I want to live in?"

And then living that answer — now.

Choose:

- Collective over individualistic

- Community over monopoly

- Conscious capitalism over exploitative capitalism

- Decentralised over hierarchical

- Regenerative over extractive, to restore an already decimated planet

Because the future isn’t something we watch unfold.

It’s something we shape — with every choice, investment, and intention.

A Regenerative Future: What Role Can You Play?

You may not have the power to rewrite global economic rules. But your personal wealth — in all its forms — can still be a force for change. Beyond immediate impact, adopting a regenerative future mindset means aligning your wealth decisions with the world you want to help create.

💰 Financial Capital: Invest with Intention, Grow with Purpose

At the Academy of Life Planners, we advocate for a grounded investment philosophy rooted in simplicity, resilience, and self-reliance. It’s about keeping things practical and aligned with long-term wellbeing.

Think: Simple, Low-Cost, and Diversified.

Core principles include:

- Stay invested for the long term — Time in the market beats timing the market. Let compounding do the heavy lifting.

- Diversify globally — Don’t rely on a single economy, region or sector.

- Use auto-rebalancing funds — Let smart design — not emotional stress — manage your portfolio. Consider diversifying your fund providers too.

- Plan ahead — As you near retirement, gradually shift a proportion into lower-risk assets (like bonds or cash) to cushion against short-term volatility.

- Keep costs low — High fees quietly erode long-term returns — often without adding value.

That last point — keeping costs low — is one I’ve personally started to re-examine, especially when it comes to aligning investments with a Conscious Capitalism mindset.

Passive, low-cost index funds are the heroes of DIY investing. And if your goal is ethical alignment, you might naturally look to ESG (Environmental, Social, and Governance) or Net Zero-aligned versions of these indices. These are increasingly available in low-cost formats and can screen out obvious misalignments — such as fossil fuel companies or the banks that finance them.

But it’s not always black and white. Some fossil fuel companies are actively investing in their own transition — should they be excluded entirely? And even after ESG screens are applied, a large portion of your portfolio (especially in global or U.S. equity funds) is likely to remain concentrated in the tech giants — the so-called “Magnificent 7”. At the start of 2025, nearly one-third of the S&P 500’s value was derived from just these seven companies. And while technology can accelerate progress — enabling efficiencies for a regenerative, degrowth-aligned economy — these firms also raise serious questions around monopoly power, wealth extraction, and social contribution.

One alternative is to consider actively managed funds — where fund managers pick investments with a specific lens, including impact investing or systems change. Such managers could be more likely to identify companies aligned with conscious capitalism ethos and that invest in key areas that support a regenerative future. These funds may carry higher fees, but if you’re serious about investing in the world you want to see, that may be a cost worth accepting.

There are many options out there, including funds with an explicit focus on sustainability, social impact, and transformation. A simple ChatGPT prompt, can be a great way to start exploring —

“List some retail-accessible active fund managers in the UK that focus on impact investing”

Ethical Consumer and Good with Money are also useful resources to identify financial product providers that have more of a sustainability focus. To be clear, none of this constitutes an investment recommendation. But if aligning your money with your values matters to you, it’s worth digging deeper than just low fees.

So for the final bullet above, perhaps we replace with:

- Only pay for a higher cost, where it helps provide value, such as aligning with with investing in a regenerative future

🏡 Real Productive Assets

To transform our economy into one with a regenerative focus, we are going to have to replace a lot of the infrastructure, and invest in assets that drive the type of economy we want to see.

Your home is likely your most significant real asset — and one of the smartest long-term financial decisions you can make. Owning your home not only gives you stability and freedom, but it’s also a powerful defensive investment: avoiding rent in later life is one of the best ways to reduce financial pressure. But it doesn’t stop there. Your home can also become a vehicle for impact.

By renovating with purpose — hiring local tradespeople, choosing low-carbon materials, or improving energy efficiency — you’re not just improving your living space and increasing the value of your property. You’re supporting the real economy and contributing to circular value chains. These choices matter.

Also think of energy upgrades as a form of tax-free investment. Installing solar panels, battery storage, insulation, or a heat pump requires up-front capital, but can generate a steady stream of savings on your energy bills — effectively creating a return on investment while reducing your environmental footprint.

Beyond your own property, you can also invest in the broader transition. Renewable energy infrastructure, such as wind and solar farms, is accessible through listed stocks that typically offer inflation-linked dividend income. For more of a direct impact, and a more collective and decentralised approach, crowdfunding platforms offer opportunities to support community-scale projects — from local energy schemes and EV charging networks to council-led net-zero plans — often within an Innovative Finance ISA (IFISA) wrapper, making the returns tax-free.

Want to find these types of investments? Another simple ChatGPT prompt can get you started:

“List some of the providers of ethical focused crowd-funding investments that also offer an innovative finance ISA wrapper available to retail customers in the UK”

Before investing in these types of asset, it’s worth keeping a few important points in mind:

- Risk: IFISA investments are not typically covered by the Financial Services Compensation Scheme (FSCS), so your capital is at risk.

- Liquidity: These investments are often long-term and may be hard to exit early without penalties.

- Due Diligence: Make sure to research the platform and underlying projects thoroughly — transparency, track record, and alignment with your values all matter.

By investing a proportion of your wealth into real assets with real impact, you help lay the foundation for a more regenerative future.

🧠 Human Capital: Your True Source of Wealth

When we talk about wealth, we usually think of money. But the most valuable assets you have might not show up on your bank statement. Your skills, time, energy, creativity, and sense of purpose — what we call your intangibles — make up your human capital. And they’re often your most powerful tools for shaping a meaningful life.

Here’s something worth asking:

Are you being fairly rewarded for what you bring to the table?

Because if you're pouring your talents and time into a system that undervalues you — or worse, into work that supports the very extractive models we're trying to move away from — then maybe it’s time to rethink where your energy is going.

That could mean making a shift.

Maybe it’s finally taking that leap into entrepreneurship, where you get to own what you build. Or finding a role with a mission-led organisation that actually walks the talk when it comes to people and the planet.

The B Corporation movement provides a rigorous framework to help businesses embed purpose into their operations. Certified B Corps are held to high standards of social and environmental performance, transparency, and accountability — ensuring their mission and impact are applied in practice, not just in principle.

B Corp certification can be a helpful signal when looking for mission-driven employers who walk the talk. If you're an entrepreneur, it's also worth considering for your own business. For those interested, I'm planning to pursue this for Planet Positive Planning and will share updates in future articles, offering insights into the practical steps and challenges along the way.

If making a change in career direction sounds daunting, you’re not alone. That’s exactly why we use the GAME Plan — a simple but powerful way to step back, get some clarity, and move forward with intention.

- Goals – What do you really want your future to look like?

- Actions – What small steps can you take to start moving in that direction?

- Means – What does this mean for your financial future, and how can you make the most of your resources?

- Execution – How can you turn your vision into a practical, actionable plan and stay on track?

It doesn't necessarily have to be about overhauling everything overnight. It can be about gradually realigning your work with your values, so your day-to-day life starts to reflect the kind of world you actually want to live in.

Because in the end, your time and energy are finite. Where you choose to invest them is one of the most important decisions you'll ever make.

🌱 Wrapping Up: Start Where You Are, Use What You Have

If there’s one thread running through all of this — from coconuts in Sri Lanka to crumbling civilizations and crazy wicked problems — it’s this: we live in a world on the edge of transformation.

We’re facing deep challenges — in markets, in ecosystems, in the very systems we rely on. But we're not powerless. Far from it. Whether it’s how you invest, where you work, what you build, or how you spend your time — you have more agency than you think.

And the truth is, we don’t need to wait for governments, billionaires, or some perfect system to get it right. Change doesn’t have to start with a revolution. It can begin with one mindset shift, one well-placed action, one re-alignment of your personal wealth — in all its forms — with the future you want to help shape.

So here’s an invitation:

- Get curious about your own financial choices.

- Reflect on whether your work is aligned with your values.

- Explore new ways to contribute — not just to your own wellbeing, but to the world around you.

And if consistency, like coconuts, still feels like a hard nut to crack? That’s okay. Keep showing up anyway. Keep learning, experimenting, and adjusting.

Because the future isn’t something we inherit.

It’s something we participate in — one choice at a time.

Thanks for reading, and as always — more to come soon. 🌍✨

If this resonated with you, feel free to like, share, or leave a comment — and if you found this article online, why not subscribe for more weekly reflections and insights on how to live, work, and invest with purpose?

If this provoked any reflections or questions, I would love to hear from you too!

Please do feel free to hit reply, and as a thank you, I promise to send back a recipe on how to make coconut sambal and egg hoppers! 😎

Disclaimer:

The information provided is for general informational purposes only and does not constitute investment, financial, tax, or legal advice. Please be aware that an investment strategy that is appropriate for one person, may not be appropriate to another, including yourself. Past performance is not indicative of future results. In tailoring your own personal investment strategy it is recommended to speak to a qualified professional.

Primary data sources for UN Sustainable Development Goal performance:

- UN SDG Reports:

Official updates in the UN SDG Progress Report (2023–2024) and the UN Secretary-General’s SDG Progress Report. - Poverty & Inequality:

Data from the World Bank and IMF on economic growth, poverty, and inequality. - Health & Water (SDGs 3 & 6):

Statistics from WHO and UNICEF. - Education (SDG 4):

Global data from UNESCO’s Global Education Monitoring Report. - Clean Energy (SDG 7):

Progress tracked in the IEA’s SDG 7 Report. - Climate Action (SDG 13):

Updates from the IPCC and Climate Action Tracker. - Hunger (SDG 2):

Food security insights from the UN FAO. - Inequality (SDG 10):

Trends from the OECD and UNDP. - Environment (SDGs 14–15):

Data from UNEP and the WWF Living Planet Report. - Peace & Justice (SDG 16):

Conflict and corruption insights from Transparency International and SIPRI.