Planet Positive Pulse — 14th March

World falling apart? .. Stay calm, and embrace change

As many of you will know, I'm a qualified actuary.

As an actuary you become accustomed to puzzled looks, when responding to the "what do you do?" question. In case that also includes you right now, I usually say that an actuary is a professional expert in modelling and making sense of the financial future. Hopefully that explanation makes it a little clearer, at least?

Carrying on theme of last week. AI kindly describes an actuary as a "mastermind of risk", or someone who uses math and data to "predict the future and help businesses make smarter financial decisions". Just to be clear – we cannot predict the future! But we can provide informed views on what could be plausible, and what to potentially expect.

Some claim the first actuaries were around 4,000 years ago in Ancient Babylon! But the modern actuarial profession started to form in the 18th century in the UK by using statistics to put a price on life insurance. From there we've grown as a profession, using data-driven insights to tackle a wide range of financial risks. As of last week, this now includes Planetary Solvency Risk.

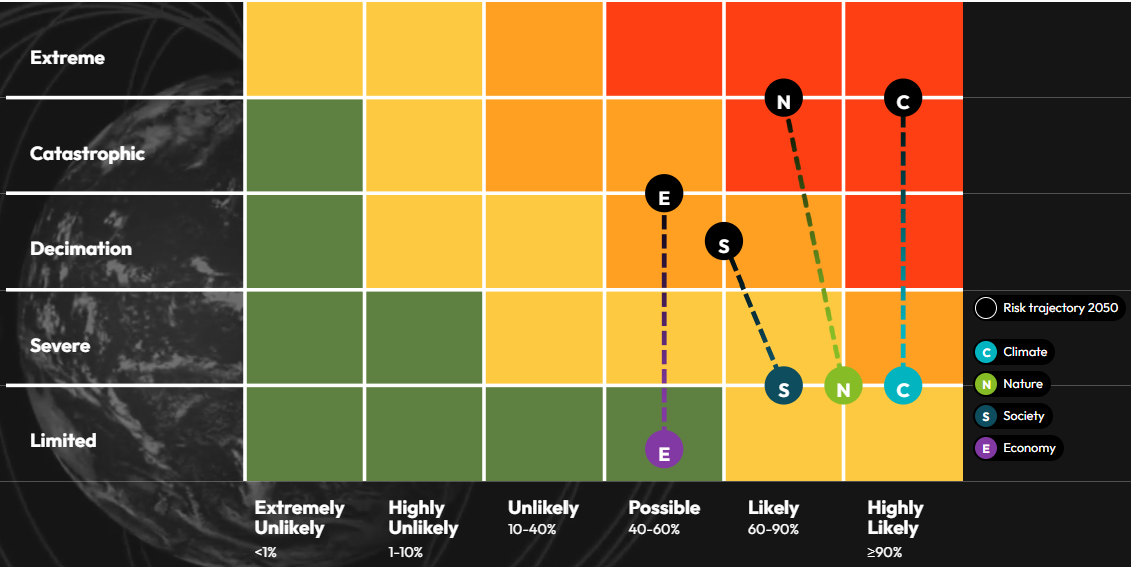

The UK actuarial profession has just launched a Planetary Solvency Risk Dashboard – a novel way to communicate that we are potentially on the way to global catastrophe by 2050.

In this blog, I promised to keep things positive. You may be thinking, how on earth do I put a positive spin on what this dashboard is telling us?!

A key point is what to expect around change. Catastrophe will likely happen if we stay on the same path. But as the world becomes increasingly uncertain and volatile, change is becoming the norm — seismic event, reaction and then counter-reaction. Keeping things the same is probably the least likely path. The question is what will be the speed of change?

There's been much dismay as the Trump administration has recently withdrawn the US from the Paris Agreement and stepped back from climate diplomacy. However as highlighted by Simon Sharpe (see Five Times Faster), the current approach to global climate diplomacy is ineffective and in much need of reform. As the saying goes, doing the same thing over and over again and expecting different results, is just insane.

Perhaps a different perspective on this story could be that, now the child has left the room, the responsible adults can get on with the serious task in hand, free from distraction? A smaller group of still significant players may actually achieve more to transform the system — creating solutions that become appealing to others, and ultimately gain widespread adoption through economic forces.

Take for example the relentless global surge in solar — e.g. Pakistan installed solar capacity equivalent to 1/3 of their existing electricity generation capacity in 2024 alone, driven by the economics of energy costs. The colossal drop in the cost of solar energy over the past decade wasn't brought about by consensus-making, but by the bold moves of a few key global players who pushed industry development past a critical tipping point — see EEIST report.

Has this helped bring you back to a positive place yet? If not, then continue reading. The first story, in particular, illustrates that transformational change is not only entirely possible, but may also be ultimately inevitable.

🌟 Positive Climate News

The Low Carbon Future: Key Insights from Michael Barnard

Michael Barnard recently spoke at the Green Builder Media Sustainability Symposium 2024, offering a compelling vision for a low-carbon future. His key takeaway? Electrification is the cornerstone of decarbonisation, and the transition is happening faster than most people realise. He highlighted that as fossil fuel-based energy is phased out, total energy consumption will drop significantly due to the superior efficiency of renewable energy sources.

Here are some of his key predictions for the coming decades:

- Electrification of Everything: Transport, heating, and industrial processes will rapidly shift to electricity, cutting wasted energy and emissions.

- Dominance of Renewables: Wind, solar, and battery storage are growing exponentially, making fossil fuels obsolete.

- Grid Resilience Will Improve: High-voltage direct current (HVDC) transmission will connect major renewable hubs, stabilising supply across regions.

- Battery and Storage Innovations: Lithium-ion batteries will continue to improve, but pumped hydro and long-duration storage will play major roles.

- Decline of Fossil Fuel Shipping and Aviation: Maritime freight and aviation will rely more on biofuels, hydrogen, and electrification where feasible.

- Heavy Industry Decarbonisation: Steel and cement production will transition to electric arc furnaces, green hydrogen, and carbon capture where necessary.

- Agricultural Advances: Precision agriculture, drones, and bio-based fertilisers will cut emissions and improve efficiency.

Barnard's talk reinforced that while challenges remain, we have the technology and momentum to fully transition to a low-carbon economy. The key is accelerating deployment and scaling up existing solutions.

The Global South’s Cleantech Revolution

A recent report from RMI reveals a remarkable shift — the Global South is adopting renewable energy at twice the pace of the Global North. Countries across Latin America, Africa, South Asia, and Southeast Asia are embracing clean technology as the fastest and cheapest path to prosperity.

Here are some of the key trends driving this revolution:

- Capital is moving to renewables: In 2024, investment in clean energy outpaced fossil fuels by 7x across the Global South, a stark contrast to the even split seen a decade ago.

- Solar and wind are scaling rapidly: The share of electricity from solar and wind is growing at 23% per year, outpacing the 11% seen in wealthier nations.

- Leading by example: One-fifth of Global South nations — including Brazil, Morocco, Bangladesh, and Vietnam — have surpassed the Global North in key solar and wind adoption metrics.

- Cost savings drive adoption: In Pakistan, satellite images reveal rooftops densely packed with solar panels, while Tanzania has tripled electricity access in just a decade.

- Challenges remain: 700 million people still lack electricity, particularly in parts of Africa. Regulatory reforms and targeted financial support are critical to accelerating clean energy expansion in low-income nations.

With solar panel costs falling by 35% in 2024 alone, the Global South’s energy transformation is set to continue at an astonishing pace. This shift isn’t just about sustainability — it’s about unlocking economic opportunity for millions.

Mercedes' Solar Paint Turns EVs into Mobile Power Stations

An innovative solar paint developed by Mercedes-Benz could transform electric vehicles (EVs) into self-charging power stations, reducing reliance on external charging infrastructure. With 27% of potential EV buyers citing charging availability as their biggest concern, this breakthrough could significantly enhance the EV ownership experience.

Here’s how it works:

- Ultra-thin solar modules (just five micrometres thick) are embedded into a special paint coating, allowing the entire vehicle exterior to generate power—not just the roof.

- New power converters boost the low voltage generated by the solar cells directly to an EV’s high-voltage battery system.

- The technology could generate up to 12,000km (7,456 miles) of range per year — covering almost the entire annual driving distance of many motorists in places like Germany and the UK.

- In sun-rich locations like California, the technology could fully power an EV while parked, enabling vehicle-to-grid (V2G) capabilities, where EVs feed energy back into homes or the grid.

The solar paint is free from rare-earth elements and silicon, making it cheap to produce and easy to recycle. However, mass production challenges remain, and Mercedes-Benz is trialling different application methods throughout 2025.

If successfully commercialised, this technology could revolutionise EVs, turning them into mobile power stations, reducing energy costs, and accelerating EV adoption globally.

German Cities Leading the Transition Away from Gas

To meet Germany’s climate neutrality goal by 2045, cities like Mannheim and Hamburg are phasing out natural gas for heating and replacing it with district heating and heat pumps.

- Mannheim aims to shut down its gas network completely by 2035, supported by a €10,000 subsidy programme for households switching from gas heating.

- Hamburg is mapping out energy solutions to disconnect entire neighbourhoods from the gas grid, with detailed plans expected by 2026.

- Hydrogen is not a viable solution for household heating due to high costs, inefficiency, and infrastructure challenges. Over 50 independent studies confirm that heat pumps and district heating are the way forward.

- Cities are investing in electricity grids, expanding infrastructure, and launching public awareness campaigns to ensure a smooth transition.

This shift is not just happening in Germany. Denmark will ban natural gas heating by 2030, and Swiss cities like Basel and Zurich are shutting down gas grids. With the EU Gas Directive requiring decommissioning plans, more cities across Europe are expected to follow suit.

Mannheim’s approach — combining financial support, public engagement, and infrastructure investment — provides a blueprint for other cities looking to cut fossil fuel dependence and move towards climate-neutral energy.

Want more uplifting and solutions-focused news? Then check out Climativity Fix The News, and follow Ecologi on social media.

🚀 Inspiring Climate Start-up

PowerRoll: Solar Film Transforming Renewable Energy

Imagine if solar power worked like wallpaper — thin, flexible, and easy to install anywhere. That future is already here with PowerRoll, a UK-based start-up redefining solar energy.

Their ultra-thin, lightweight, and low-cost solar film eliminates the traditional barriers of rigid panels, unlocking endless opportunities for clean energy adoption. Unlike conventional solar panels, PowerRoll's patented solar film can be applied to curved stadium roofs, floating reservoirs, remote villages, and even city infrastructure.

What makes PowerRoll unique?

- Microgroove Technology: A revolutionary design using thousands of tiny channels to maximise solar absorption.

- Perovskite Solar Cells: An abundant mineral that enhances efficiency while avoiding rare-earth materials.

- Ultra-Flexible and Lightweight: Can be applied where traditional panels cannot be used.

- Mass Production Ready: PowerRoll is preparing for the rollout of its first 100MW commercial-scale plant and scaling up for global deployment.

PowerRoll’s innovation means solar power is no longer restricted to rooftops or solar farms — it can wrap around buildings, infrastructure, and even vehicles, bringing clean energy to places never before possible. With commercial production launching in the UK, this could revolutionise renewable energy worldwide.

🚀 Inspiring Climate Non-profit

The Big Solar Co-op: Bringing Solar to Every Big Roof

Why hasn’t every big roof in the UK got solar? In an energy and climate crisis, it just doesn’t make sense. The Big Solar Co-op is on a mission to change that, one rooftop at a time.

This not-for-profit, carbon-first, volunteer-led organisation is installing solar panels on commercial and community buildings across the UK — from factories to doctor’s surgeries — to help cut emissions and energy costs.

How it works:

- No upfront cost: The Big Solar Co-op designs, installs, owns, and maintains solar panels on big energy-using buildings.

- Cheaper, greener electricity: Building owners get low-cost renewable power, cutting carbon emissions and saving money on energy bills.

- Flexible partnerships: Long-term agreements ensure sustainability and cost savings.

- Volunteer-led expansion: Want to see more solar in your area? The Co-op provides training and support for volunteers to help bring solar to their communities.

- Community investment: The Big Solar Co-op runs community share offers, giving people a chance to invest in local renewable energy.

🔎 Could your local area benefit? Think of a community building, school, warehouse, or business near you that could take advantage of Big Solar’s offer of PV solar. Could you help make it happen?

To learn more, visit The Big Solar Co-op and explore how you can get involved, volunteer, or invest.

This news simply provides information and does not offer investment advice on whether this is a suitable investment for you.

🔍 Climate Job Openings

Analytical Development Intern – Hoxton Farms

A unique opportunity to join Hoxton Farms, a pioneer in cultivated fat technology, as an Analytical Development Intern. You’ll work alongside scientists, engineers, and technicians, performing biochemical assays and supporting large-scale production of sustainable, cultivated fat.

- Salary: £38K per year (pro-rated for internship duration)

- Location: London (Old Street), full-time, on-site

- Key Responsibilities:

- Running biochemical assays (e.g., ELISA, spectrophotometry)

- Developing new analytical methods to enhance performance

- Supporting process optimisation for cultivated fat production

- Requirements:

- Final-year undergraduate or graduate in chemistry, biochemistry, or life sciences

- Hands-on lab experience from coursework, research, or internships

- Strong data analysis skills

- (Bonus) Experience with chromatography, mass spectrometry, and regulated lab environments

Hoxton Farms is committed to diversity, inclusion, and sustainability. If you’re passionate about alternative proteins and lab-based innovation, this could be your perfect fit!

These are some highlighted UK vacancies coming from ClimateBase, ClimateTechList, 80,000 Hours, as well as through my own network.

💰 Sustainable Investing Updates

People's Pension Pulls £28bn from State Street Over ESG Retreat

In a major shake-up, The People’s Pension, one of the UK’s largest pension funds, has withdrawn £28bn from US asset manager State Street, citing concerns over its retreat from environmental, social, and governance (ESG) investing. Instead, the pension fund has shifted £20bn to Amundi and £8bn to Invesco, both of which have stronger responsible investment commitments.

This move highlights a growing divide between European and US asset managers on climate action. Mark Condron, chair of trustees for The People’s Pension, stated that the decision prioritises sustainability, active stewardship, and long-term value creation.

With State Street, BlackRock, and Vanguard facing criticism for weakening their ESG commitments, this shift underscores how pension funds can drive change by demanding stronger climate strategies from asset managers.

This news simply provides information and does not offer investment advice on whether this is a suitable investment for you.

Banks Still Finance Fossil Fuels, Says Make My Money Matter

A new campaign by Make My Money Matter has revealed that the UK’s five largest high-street banks — Barclays, HSBC, Santander, Lloyds, and NatWest — have pumped over $556 billion into fossil fuels since 2016. In 2023 alone, they provided $55 billion to oil and gas companies, despite global warnings against fossil fuel expansion.

The campaign urges individuals and organisations to hold their banks accountable by:

- Engaging with their banks: Demanding clear deadlines for phasing out fossil fuel financing.

- Switching to green banks: Moving accounts to ethical alternatives like Triodos, The Co-operative Bank, or Nationwide.

- Collaborating for impact: Following the lead of Oxfam, Christian Aid, and the University of Cambridge, which have begun cutting ties with fossil-financing banks.

With growing public pressure and businesses taking action, this campaign highlights the power of finance in driving climate solutions. Could it be time to rethink where you bank?

This news simply provides information and does not offer investment advice on whether this is a suitable investment for you.

Is the US Equity Bubble About to Burst?

Although not strictly a sustainable investing topic, this is nonetheless a topical investing news story. Despite expectations of continued US equity market growth in 2025, significant downside risks remain. Analysts warn that current valuations are detached from fundamentals, making investing in equities feel like speculating on speculation.

Key risks include:

- Market Concentration: Just seven stocks account for one-third of the S&P 500’s value, raising concerns about overreliance on a handful of companies.

- Interest Rate Uncertainty: Hopes for Federal Reserve rate cuts are fading, while proposed US tax cuts bring questions about fiscal stability.

- Global Trade Tensions: Recent tariffs could disrupt global trade and exacerbate inflation pressures.

For those nearing retirement or investing for the long term, balancing growth and risk has never been more crucial. Traditional diversification techniques may no longer be enough to manage financial risk sufficiently.

For similar regular updates on the financial markets, please follow Milliman Financial Risk Management's on Linked-In.

This news simply provides information and does not offer investment advice on whether this is a suitable investment for you.

📖 Academy of Life Planners Insights

Living Life in Crescendo: The Best Is Yet to Come

Inspired by Stephen R. Covey and Cynthia Covey Haller, the Academy of Life Planning’s GAME Plan helps individuals redefine purpose and fulfilment in their later years. With a 35% rise in UK students over 50, lifelong learning is booming. From new careers to PhDs, people are proving that midlife is just the beginning.

A Crisis of Trust: Why Pension Savers Are Taking Control

As the UK government moves to tax unused pension savings, trust in traditional pensions is eroding. Many are choosing to withdraw funds early, fearing further policy shifts. While saving into a pension to some extent is still important, The Academy of Life Planning advocates for independent financial strategies as a useful additional approach to consider, to reduce your exposure to potential future impacts from government intervention.

The GAME Plan: A Holistic Approach to Wealth and Well-Being

Wealth isn’t just money — it’s physical, mental, emotional, and spiritual well-being. The GAME Plan ensures balance across all areas, with actionable steps to achieve long-term fulfilment. Financial success means little without health, relationships, and purpose.

Curious to discover more about any of the themes discussed above, then check out the Planet Positive Planning website.

Copyright Planet Positive Planning Limited. Contact me by email at neil@planetpositiveplanning.com. Planet Positive Planning Limited is a service sector trading company, providing "educational financial services" and regulated by the Competition and Markets Authority and Registered in England and Wales number 15759784. As defined by PERG8.26 of the FCA Handbook, these services do not require FCA regulation. Registered office address 2 Joshua Pedley Mews, London, E3 2ZE, United Kingdom. Information Commissioner's Office reference number C1531204.