Ready for a Volatile Future? — Time to Build Financial Resilience

Climate change and economic uncertainty are reshaping how we think about wealth. This blog explores smart ways to protect your money, build resilience, and invest for a sustainable future. Learn how diversification and future-focused decisions can help secure your long-term financial well-being.

Will 2025 be a special year?

As a mathematician I see something special in the number 2025. The fact that it simultaneously satisfies both of these formulas constructed from the digits 1 to 9, to me, is a thing of beauty. Although I appreciate to the non-mathematically minded, you may be thinking what the fuss! 😄

2025 = (1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + 9)2

= 13 + 23 + 33 + 43 + 53 + 63 + 73 + 83 + 93

It is also a significant milestone. A quarter of century passed since the Millennium. A halfway point between the turn of the century and 2050 — a date when the UK, as well as many other nations, are planning to be Net Zero. It does feel hard to believe that in the same period of time since the Sydney Olympics and the Spice Girls splitting up, we need to have achieved all that is required to decarbonise our economy. Surely, change needs to accelerate. Is this the year?

Recent political events certainly seem like they are about to bring significant change, but unfortunately in the wrong direction for the planet. We'll see how current announcements and events unfold. What does give me a degree of hope, is reflecting on the last time there was a lurch to the political right back in 2016. Subsequent years saw a counter-reactionary movement. After the votes for Brexit and Trump, we eventually saw the rise of Greta and Extinction Rebellion, but also importantly a noted acceleration in economic efforts to strive for the Paris Agreement Goals.

Will it happen again?

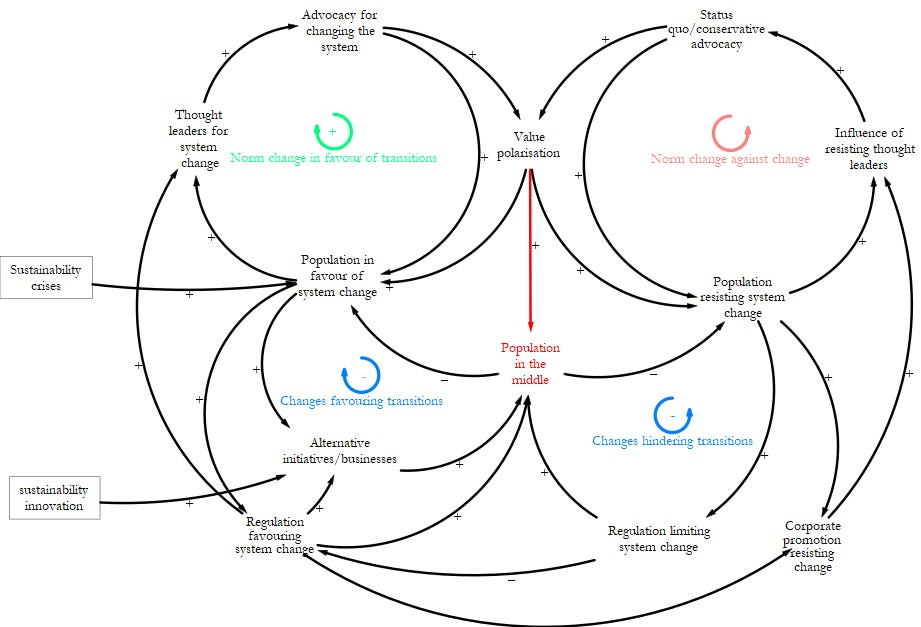

One interesting analysis I read recently, came from Hans Stegemen (for those interested in economics I recommend his Systems Economics SubStack). He highlights that when we go through a period of significant transition, cycles of change and resistance ultimately feed off and accelerate each other — see the diagram below.

If we want significant change, turbulence is to be expected, and this leads to reinforced efforts for change. The hope is that as we go through this increasing turbulence, the balance shifts in favour of long-term sense. From a planetary perspective, we already see a small glimmer of this at the start of the year. The desire for "Drill, baby, drill" is struggling to get traction in Wall Street, as the economics don't necessarily make sense.

Source, Author, based on Eker et al. (2024)

Actuaries sounding a wake-up call

The UK actuarial profession has just issued its high-profile risk analysis and resulting recommendations, to act as a wake-up call for the finance industry around the seriousness of climate change risk.

The headline statement from IFoA Council member Sandy Trust: "The global economy could face a 50% loss in GDP between 2070 and 2090, unless immediate policy action on risks posed by the climate crisis is taken." Populations are already impacted by food system shocks, water insecurity, heat stress and infectious diseases. If unchecked, mass mortality, mass displacement, severe economic contraction and conflict become more likely.

In response to this risk, the actuarial profession issues a bold recommendation to create a new supra-national body, reportable to the UN, to assess and manage "planetary solvency risk". The risk of insurance companies collapsing is minimised to a very small degree, by regulators holding insurers to account on a rigorous approach to solvency risk management. Surely the risk of societal collapse due to climate change, which is far more of a human catastrophe, deserves the same level of rigour?

It should be noted it is not just the actuaries calling out the risk of societal collapse. A recent study by Kings College London makes a bold prediction that UK society could collapse due to widening inequalities in wealth. Effective altruists also highlight that we are not giving sufficient due attention to the risk of adverse AI developments, pandemics and nuclear war, given the potential for extreme consequences.

I appreciate this is a drum I keep beating, but I genuinely believe it shifts how we should think about managing wealth. Significant long-term risks like these deserve attention — we can’t afford to be lulled into the false sense of stability that much of the finance industry has grown used to. Focusing too much on short-term risk is like debating the seating plan for the captain’s table while on the Titanic as it steams towards a huge iceberg.

That said, it’s important to maintain balance. These are all potential scenarios of what could happen, not what will definitely happen. If events unfold in the right direction, there’s also an incredible opportunity for humanity to achieve true sustainability — see my recent blog article about the case for urgent optimism. Renewables are being deployed faster than predicted, AI is advancing beyond expectations with game-changing potential, and DeepSeek has recently shown how cost and energy constraints can be overcome.

But what if there is no escaping the iceberg?

How do we plan for a crisis scenario?

What have I considered in my own planning for a more uncertain future?

Investing in my Health — For me, this is essential. It supports my ability to earn a living now, and determines how long I’ll be able to do so in the future. In times of crisis — whether another pandemic or dealing with extreme conditions — good health increases my resilience.

For those living paycheque to paycheque and looking to cut costs, I wouldn’t recommend sacrificing anything that supports your health and well-being. If a gym membership is well-used, keep it; if not, find other ways to stay active. Mental health is just as important, especially in high-stress situations. Having struggled with anxiety in the past, I’ve found the mantra "healthy body, healthy mind" invaluable in building strength to deal with stressful situations.

Investing in Myself — Adaptability and flexibility are essential for being able to respond to unforeseen crises. Think back to the times of Covid — many saw their income vanish overnight, but those who could adapt and leverage their skills found new opportunities in the virtual world. As the world changes at an ever-increasing pace, staying responsive to market demand is more important than ever.

Diversifying my skills. I'm focusing on developing my skills where I can apply a human touch, particularly with the advent of AI. AI could soon revolutionise the world of investment advice. The other day, I was in conversation with a friend who recently launched an AI start-up. He envisaged a future where AI is used to analyse client conversations and automatically generate portfolio recommendations, that also meet compliance requirements with minimal human input. But can AI truly replace human interaction? The ability to ask the right questions, to empathise, to provide perspective and reassurance, and to understand nuances in balancing financial solutions with personal needs and desires. All of this still seems something uniquely human.

Diversifying my income streams in later life. Where financial assets may underperform due to significantly poor investment returns, continuing to earn — whether through part-time work or a business — can be a vital safeguard. Later life is an opportunity and the ability to develop my skills and explore alternative vocations leads not only to a purposeful and fulfilling life, but financial security and resilience.

Building my network — If I ever find myself out of work or needing practical help in a crisis, having a strong network could make all the difference. As they say: "Lone wolves struggle — packs survive". Knowing people with different skills has already helped me navigate the challenges of starting a business part-time. It’s not just about career opportunities; it’s about having a support system to lean on when things get tough. In uncertain times, the right connections can provide advice, reassurance, and new ways forward.

Investing in a UK property portfolio — One of the biggest climate risks in the UK is increasing flood exposure, which could push many properties into uninsurable territory — especially once the government-backed Flood Re scheme ends in 2039. By 2050, 1 in 4 properties may be significantly affected by flood risk. However, the optimist sees this differently: 3 in 4 properties won’t be, meaning carefully chosen, risk-assessed properties could remain climate-resilient assets, when other financial assets may be more exposed.

Beyond flooding, the potential collapse of the Atlantic Meridional Overturning Circulation ("AMOC") — one of the most at-risk irreversible tipping points — could bring harsh North American-style winters to the UK. This underscores the need for modern, heat-efficient, and well-ventilated homes to withstand future temperature extremes. However, compared to other regions, the UK may still experience relatively manageable climate impacts, making it a comparatively more attractive long-term property investment.

During economic downturns, basic needs become even more valuable, and few are more fundamental than having a secure roof over your head. Owning property outright removes the pressure of paying rent later in life — particularly if investments or savings struggle to keep up with economic conditions.

Investing in energy efficiency further strengthens financial security by reducing the need to fund future energy costs. Additionally, investing in a passive rental income from a second property can provide another layer of resilience, offering financial stability in uncertain times.

Ensuring I'm inflation protected — As a part-time actuary, a topical discussion point among my colleagues has been the impact of climate change on inflation. The consensus with my colleagues is that climate change and the Net Zero transition is likely to drive higher and more volatile inflation than we’ve seen before — see this article for more details.

For instance, if the AMOC collapses, global wheat production could drop by 50%, causing food prices to soar. Even without such a dramatic event, weather-driven crop failures are already leading to food price spikes.

Traditionally, the stock market has been the main hedge against long-term inflation. However, diversifying beyond equities can add resilience, for example:

- Commodities – Exchange-traded funds (ETFs) offer low-cost access to diversified commodity baskets, including food items, energy, and metals.

- Inflation-Linked Investment Trusts – Some investment trusts invest in energy-generating assets like wind and solar farms, providing income that grows with inflation. In a crisis, energy provision is likely to remain highly valued and so help keep this type of investment resilient.

While these options may not match traditional equity returns, allocating a portion of your portfolio can help increase resilience in dealing with inflation risk.

Rethinking the term "safe or defensive asset" – in a future climate crisis scenario will government debt still be risk free? Whilst there are enough checks-and-balances in place that it is highly unlikely governments will explicitly default on their debt. Governments such as our own are already struggling financially, and the added burden of funding climate adaptation and recovery could push them to the limit. The pandemic showed how costly large-scale intervention can be. While governments have tools to manage debt, recent crises have shown how quickly markets can lose confidence, causing bond values to plummet. In 2022, UK government bonds were more volatile than the stock market, undermining their role as a "safe" asset.

One alternative I’ve considered is that of "social investments" — direct funding for projects with tangible economic and environmental benefits, such as community energy, EV charging infrastructure, and local council net-zero plans.

These investments carry a higher default risk than government bonds, as well as other specific risks. The platforms that provide these should undertake a thorough due diligence of these, so that you have a clear picture. They are also not protected by deposit guarantees — therefore, as usual, spreading across a basket of individual investments is advisable. However, financial returns are typically provided as a stream of interest and capital payments similar to bonds. Being standalone investments they are also less exposed to market sentiment-driven volatility. This does also mean that they are harder to get out before they mature, though secondary marketplaces often exist for reselling. But for some of my longer term investments, my preference has been to take on some more measured default risk and lack of flexibility to sell, in exchange for less risk of volatile pricing.

The worsening climate crisis means that protecting the planet is something that is increasingly important to me. Beyond financial returns, these type of investments also give me something more. Helping me align with my values by actively contributing to a more sustainable future — offering both economic and personal rewards.

Investing in Net Zero aligned stocks — Stock market performance is dependent on global GDP, which in turn depends on the state of the planet and its available resources. Human action over the coming decades will determine what state the planet will be in. Human action is very difficult to predict.

It feels like the range of potential future outcomes has never been wider, and so calls for a balanced approach — as a result I've invested in the other areas discussed above, but at the same time, I also still retain a significant proportion invested in the stock market.

I recently had quite a heated debate with a close friend of mine as to whether the climate crisis means you should invest in equity funds that prioritise Net Zero alignment. I'm a risk specialist, he is an investment specialist. We each come from different view points, but needless to say it is a complex question, and hopefully the source of more insights to come in future blog articles!

One key question: does investing in stocks actually drive meaningful change? Buying shares doesn’t necessarily change company behaviour — in most cases, those shares already existed. Other investments or uses of your capital, such as funding social impact projects, launching a climate-positive venture, or investing your money to earn a return that is then used to fund donations to charitable causes, could arguably be more effective in driving systems change.

For me, investing in Net Zero aligned stock funds is more about the moral choice. Protecting the planet is a core value of mine, and I wouldn’t want my financial capital contributing to a future climate disaster. While this approach may limit my investment universe and carry uncertain (and the risk of lower) returns, it aligns with what is important to me. Whether this will lead to better returns? Only time will tell.

Looking Ahead to 2025 and Beyond

2025 isn’t just a halfway mark to 2050, or a mathematical curiosity — it’s a reminder of how quickly time is moving and how urgent action has become. Meeting Net Zero goals, building a more sustainable economy, and preparing for an uncertain future all require real transformation now, not later.

However change never comes easily. Turbulence is to be expected. Turbulence leads to an increased risk to us achieving the life we want to lead. A changing world means that we need to reflect on how best to protect our wealth and build resilience, and avoid the risk of being lulled into a false sense of stability by outdated economic views and assumptions.

For me, financial planning has never been just about investment returns — it’s about building a purposeful and values-driven life where I'm able to do the things I love, whilst giving back to others. But also ensuring security, incorporating impact, and maintaining adaptability in a changing world. That’s why I focus on diversifying my skills, income sources and wealth (both human and financial).

As 2025 begins, there’s no doubt this will be a defining time. The choices we make now will shape our financial future — and the planet — for years to come.

👉 First time here? Please do sign-up for free additional content (and remember to confirm your email address) that will include further insights on building personal financial resilience in a changing world.

💬 If this gave you a new perspective, please do share it with your network, as a sign of appreciation. Please also drop me a comment — I’d love to hear your thoughts.

🌍 Want to align your personal wealth strategy with your values? Visit Planet Positive Planning to find out more about how I can help.

Disclaimer:

The information provided is for general informational purposes only and does not constitute investment, financial, tax, or legal advice. Please be aware that an investment strategy that is appropriate for one person, may not be appropriate to another, including yourself. Past performance is not indicative of future results. In tailoring your own personal investment strategy it is recommended to speak to a qualified professional.